Repost: Megan O’Brien, "5 Psychological Pricing Tactics That Attract Customers..."

During a discussion of biases, the topic of “$2.99’ vs “$3.00” came up. Pricing often seems like voodoo to me. I understand how seeing a higher price, then a lower price, can make someone feel like they’re getting a deal. It is harder to imagine “left-digit bias”—that people see $2.99 and don’t immediately recognize it’s $3.

One day, I want to open a vegetarian restaurant that is transparent about the pricing. That wont be in the next few years. So here’s an article on psych tactics that explain those weird pricing structures you see.

Notes: This is part 4 of a longer series, which is worth reading. This blog attempts to point you in the direction of other blogs, in efforts to get people off social media. I do not intend to steal content/traffic. If you like the article, go checkout the others by O’Brien/Netsuite.

Original link from Netsuite: https://www.netsuite.com/portal/resource/articles/ecommerce/psychological-pricing.shtml

A more recent article by O’Brien I also rec: https://www.netsuite.com/portal/resource/articles/business-strategy/subscription-based-pricing-models.shtml

5 Psychological Pricing Tactics That Attract Customers, With Examples

Megan O’Brien ; April 1, 2021

In short:

Psychological pricing, a subset of pricing strategies, is commonly used to impact customer behavior.

Research has shown that certain ways of formatting prices can spark a subconscious response from a customer and encourage a purchase.

Inexpensive and easy to implement, these tactics can be used in addition to pricing strategies to boost their effectiveness.

In the most recent article in our subscription pricing series, we delved into various pricing strategies you can use to attract and retain customers. However, the strategy session doesn’t end there. There is another pricing framework you can easily use to boost growth: psychological pricing.

Psychological pricing, a subset of pricing strategies, comprises tactics commonly used to impact customer behavior. Research has shown that certain ways of formatting prices can spark a subconscious response from a customer and encourage a purchase. Because they are inexpensive and easy to implement, many businesses across industries use at least one psychological pricing tactic when creating or adjusting their pricing. As an added bonus, you can easily layer psychological pricing tactics over pricing strategies to boost the strategies’ effectiveness — and use them with both subscription and non-subscription offerings.

Get an overview of 5 psychological pricing tactics you can use to impact customer behavior:

Price Anchoring

Definition: Price anchoring recognizes that consumers tend to depend too heavily on an initial piece of information (the anchor) when decision-making. For instance, a jeweler might first present an engagement ring worth $18,000 as the price anchor. It then presents a ring worth $15,000, which to the customer seems much more reasonable and a “good deal” in comparison to the anchor. Thus, the customer is more likely to purchase the second ring than if they hadn’t seen the anchor.

Best for: companies with a tiered pricing model that offers various versions and associated features of the core product, at different prices.

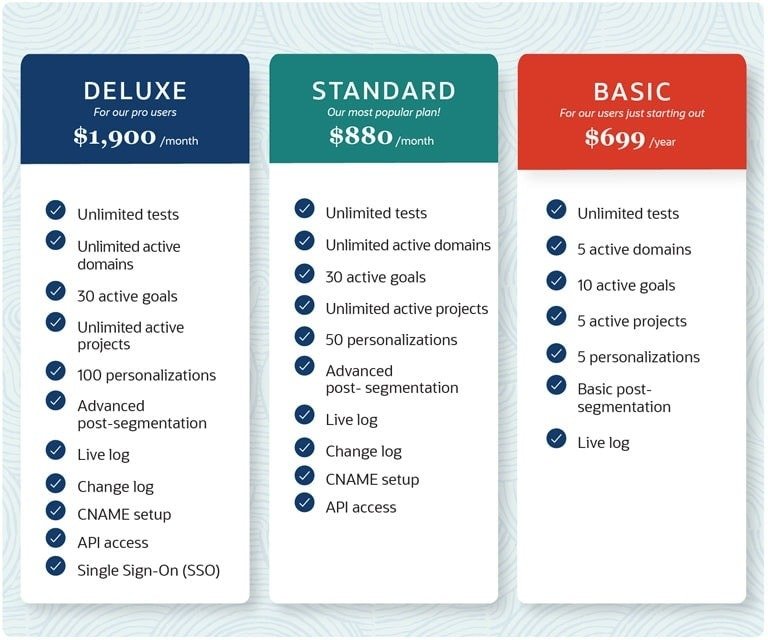

Example: A company sells its A/B testing tool in three price tiers. Below, you can see the price anchoring strategy on full display: The first option listed, Deluxe, serves as the customer’s initial piece of information, since most tend to look at the left-hand side of a graphic first. It’s more than twice the price of the next option but only a little bit different in features, setting the stage for the next tier, Standard, to seem like a great deal.

This imaginary company’s pricing chart is an example of price anchoring.

Advantages: The price anchoring tactic can direct users to your preferred price tier and help them make the decision to buy your offering.

Requirements: To use price anchoring, you’ll need an offering with multiple pricing options which customers can easily compare.

Charm Pricing

Definition: Charm pricing refers to the use of prices ending in the number nine because of the “left-digit bias,” a phenomenon in which consumers’ perceptions and evaluations are disproportionately influenced by the left-most digit of the product price.

Research shows ending prices in “99” (e.g., $599) can result in more sales than rounding up to the nearest round price point (e.g., $600). The human mind subconsciously rounds that $599 to $500, as opposed to $600 — even though it’s unreasonable. In a study noted in the book “Priceless ,” charm prices outsold rounded prices by 24%.

Best for: companies with non-luxury products that want to convey a “deal.”

Example: A transcription software costs $9.99 a month. Due to that left-digit bias, many consumers think, “This product is significantly less than $10. It’s a great deal.”

Advantage: With charm pricing, you can use the difference of one cent to majorly impact the users’ perception of your offering’s price.

Requirements: To use charm pricing, your company must want to give the impression of a “deal” for its products. The tactic doesn’t work well with luxury or recreational goods, which actually benefit from rounded prices.

Odd-Even Pricing

Definition: Odd-even pricing is similar to charm pricing but applied on a broader scale. This tactic leverages the belief that, psychologically, buyers are more sensitive to certain ending digits.

“Odd pricing” refers to a price ending in 1,3,5,7,9 (e.g., $9.93). “Even pricing” refers to a price ending in a whole number or tenths (e.g., $20.00 or $20.50). Odd pricing tends to be more popular because it indicates a deal in a customer’s mind, making them more likely to buy. That doesn’t mean even pricing doesn’t have a place, though. Luxury brands tend to use even pricing to create perception of premium. Check out pricing on men’s activewear at Old Navy versus Nike : Old Navy uses a mixture of odd and charm pricing, whereas Nike uses even pricing.

Companies aren’t limited to either odd or even pricing, though. For instance, Nike uses even pricing on all of its full-price products. However, its sale section uses odd pricing to indicate the deal.

Best for: Even pricing works best for luxury items, while odd pricing tends to work best for most other products.

Example: A wine subscription company offers two types of monthly boxes: For $29.43 a month, the standard box delivers four bottles of wine curated to your taste. For $60 a month, the same company will send four curated bottles that are considered “premium.” While $29.43 indicates a good deal and will likely attract customers who subconsciously round the price down, the $60 option embraces the expense to further the impression of luxury and exclusivity.

Advantage: Odd and even pricing can help create the perception of a deal and of luxury, respectively.

Requirements: There are no strict requirements, but companies should ensure their odd-even pricing use resonates with customers and creates the desired value perception of their product.

Decoy Pricing

Definition: The decoy pricing tactic is based on the “decoy effect,” by which individuals tend to have a specific change in preference between two options when also presented with a third option that is inferior in every way except one. The presence of the “inferior” third option makes the first two seem more attractive.

Best for: Companies that have a preferred option(s) to which they want to direct customers. For instance, decoy pricing has become more popular in the news media industry as companies try to move customers from print to digital. In his book “Predictably Irrational ,” author Dan Ariely notes that, at one time, the Economist had three magazine offerings:

Web only for $59 a year

Print only for $125 a year

Web and print for $125 a year

It doesn’t exactly take a savvy businessperson to recognize that “print only” is a terrible option, to the point it seems silly to include it. However, the Economist included this option because it caused consumers to view the web and print options much more favorably in comparison.

Here were the results:

This chart shows the effect of decoy pricing on the Economist’s magazine sales.

(Image credit: InvoiceBerry via The Grasshopper Blog )

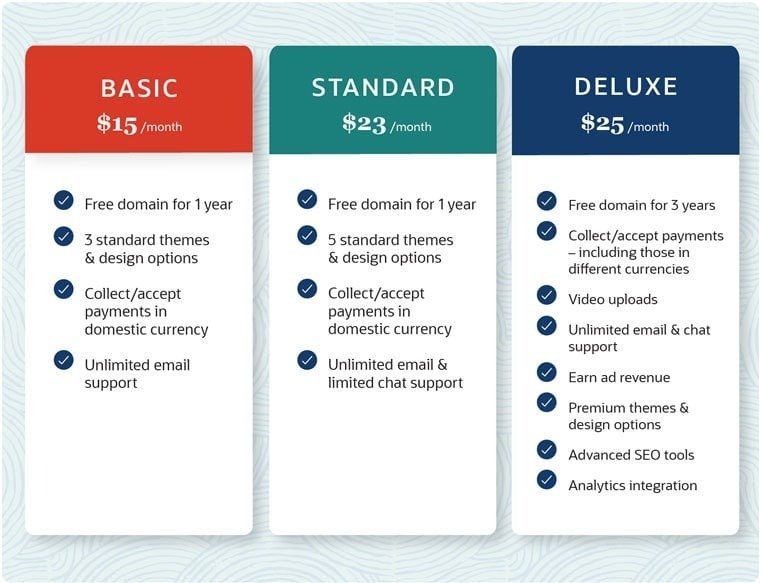

Example: A website design platform has three pricing tiers:

This imaginary company’s pricing chart is an example of decoy pricing.

Can you spot the decoy? If you guessed Standard, then you guessed right! Since it’s only $2 less than Deluxe — but with far less functionality — customers looking for capabilities or features would likely opt for Deluxe. And those looking for less functionality would tend to gravitate towards the Basic option since it has similar functionality to Standard at a lower price point.

Advantage: You can use decoy pricing to direct customers to your preferred pricing plans.

Requirements: To deploy decoy pricing, you’ll need an offering with multiple pricing options, including a less-appealing, “inferior” option.

Center Stage

Definition: This tactic is based on the center stage effect, which dictates that, out of a range of products presented side-by-side, we tend to be drawn to the one situated in the middle .

Best for: any company, as long as it has multiple pricing options to choose from and a preference on which one(s) get chosen.

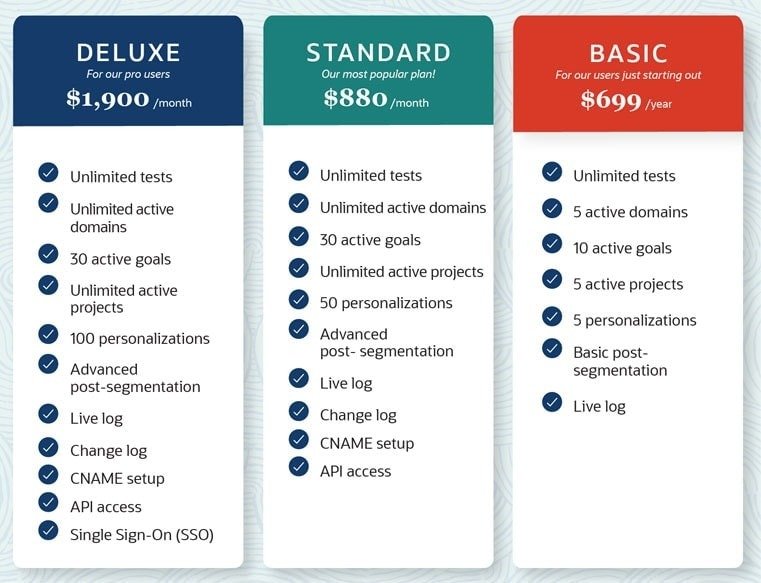

Example: We can bring the A/B testing company from our price anchoring example back to illustrate the center stage-based tactic. This company wants consumers to gravitate toward the Standard plan because they’ve seen Deluxe drive folks away with its high price point, and Basic doesn’t have the same earning potential. So, the team places the Standard plan in the middle of the pricing sheet, where consumers gravitate.

This imaginary company’s pricing chart makes use of the center stage effect.

Advantages: Taking advantage of the center stage effect can attract customers to your preferred or most popular plan with no alterations to other prices or offerings.

Requirements: Again, companies must have multiple pricing options to choose from.

Implementing Psychological Pricing Tactics

Psychological pricing tactics are most effective when used at the appropriate time and place. When choosing which tactics to implement, consider your product or service, business model and goals — as well as the subscription pricing model and pricing strategy previously chosen.

The Best Psychological Pricing Tactics for Each Subscription Pricing Model

Complementary Psychological Pricing Tactic

Odd-Even, Charm

Center Stage, Decoy, Price Anchoring, Odd-Even, Charm

Center Stage, Decoy, Price Anchoring, Odd-Even, Charm

Odd-Even, Charm

Odd-Even, Charm

Subscription Pricing Model

Flat-Rate

Tiered

Usage-Based

Per-Added-Module

Per-User

Psychological pricing is about finding that “sweet spot” in customers’ minds, which in itself can take a couple of tries to get right. That “sweet spot” can also change based on market conditions — for example, restaurants significantly tweaked menu prices in 2009 to appeal to customers caught in the realities of a recession. The lesson here is that prices are hard to get right and hard to keep right. So, be open to regularly tweaking and revising your use of psychological pricing tactics — and pricing as a whole.

The Bottom Line

In the book “How Customers Think ,” Harvard professor Gerald Zaltman estimates that 95% of purchasing decisions are based in the subconscious mind. Tapping into those subconscious behaviors, patterns and biases can be an unexpectedly effective way for companies to attract and retain customers.